MTD VAT Bridging Solution

MTD VAT Bridging Solution

( support multiple VAT Excel Spreadsheet formats )

You can now easily e-file your MTD VAT data you have consolidated in an Excel Spreadsheet ( or any spreadsheet ) through AAADataX.com. Our cloud-based MTD VAT bridging solution is HMRC recognised. Using this bridging system will spare you from costly upgrading your current Accounting / VAT / Other Spreadsheet system, saving you time and money. All Accounting / ERP / Spreadsheet VAT system do provide you with the consolidated VAT data, generally known as THE 9 BOXES VAT DATA. What you current system does not have is the capabilities of e-filing these 9 boxes of VAT data to HMRC.

aaaDataX is an e-filing data interchange specialist. It will accept your current VAT output file you generate from your Accounting / ERP / VAT spreadsheet generated consolidated file and convert your file into HMRC required Jason Data format and e-file them to HMRC. We will taking care of all the technical link up and eReturn handshaking protocal to get your VAT data to HMRC.

Under MTD VAT there is no change in VAT calculation or VAT formulae. What it requires you to do is simply e-file your VAT Data through a third party eReturn system. HMRC is going to withdraw it VAT eReturn facilities in April 2019 or latest by Oct 2019. No one will be able to go to HMRC website to key in their commonly known 9 boxes of VAT data to make their VAT return soon. You are obliged to register yourself for MTD VAT and file your VAT return with a MTD VAT eReturn system.

The change will require you to link to your consolidated VAT spreadsheet and your master consolidated spreadsheet solidly with your various source VAT data and this is known as digital link. You do not need to have a new Accounting / ERP / Spreadsheet VAT system to create the digital link.

Having a Digital Link is way to prove that your VAT is consolidated correctly without tempering it in between. Up to April 2020 you may cut and paste your VAT data from different VAT data source to the master consolidate VAT file. By April 2020 your consolidated VAT file must link up to your VAT files coming from different sources if you have a complicated VAT transaction.

For most of the Sage, Iris, Quickbook etc users we have a good news for you. Most of you using these packages are smaller business. Your current Accounting package already consolidate your VAT data into a spreadsheet and you need not worry about VAT data consolidation.

Batch MTD VAT Data Upload

Batch upload and e-filing processes are the important features any pay bureau or large organisations will seek from an e-filing application. Batch process saves time ruling out the need for filling multiple spreadsheets. AAADataX.com will enable its users to upload the VAT returns of any number of clients using a single spreadsheet. Thus you will no longer need to fill in multiple spreadsheets for uploading multiple clients data. Any SFTP system can directly link to our system for passing on their VAT data securely to our system for current or MTD VAT return.

The system acknowledges the status of data upload and e-filing each time the user completes the action. If any of user's data fails to comply with the HMRC standards, system will instantly advise you about the errors in the file. You can further rectify the errors and upload the file once again.

What is a MTD VAT Bridging System?

In a nutshell, the MTD VAT Bridging system provides an intelligent bridge between your current Accounting / VAT / Other Spreadsheet system and HMRC's MTD VAT system. It allows you to continue to use your current VAT system and has the following characteristics:

-

• Fully Functional and Proven: Live MTD VAT returns have been e-filed to HMRC.

-

• Availability: It is available right now for you to use for pilot MTD VAT returns or live tests.

-

• HMRC Recognised System: Complying with HMRC's MTD VAT digital link requirements.

-

• Inbuilt Intelligence: Proving system intelligence for converting your current VAT data into the MTD

-

• VAT data format and further automatically e-filing your data to HMRC.

-

• Accepts Your VAT file in CSV or XML format.

-

• Validates VAT Data ensuring it is fully in compliance.

-

• Grant Authorisation Settings: Granting MTD VAT eReturn Authorisation inbuilt.

-

• Data Exchange is made with HMRC's MTD VAT API for submission and response from HMRC.

-

• Provides a direct link to view VAT returns data at HMRC MTD VAT system.

-

• Provides Viewing of Payments Made to HMRC at HMRC's MTD VAT System.

-

• Provides Viewing of VAT Liability and Due Dates at HMRC's MTD VAT System.

Why this MTD VAT Bridging System is Best For You?

HMRC has not changed the VAT calculation in anyway. The 9 boxes of VAT required data fields remain exactly the same under MTD VAT. What HMRC requires under MTD VAT is submitting your VAT data with digital link using latest MTD VAT API. The intelligent bridging solution fulfil precisely what HMRC MTD VAT required. Keep your VAT as is and let the intelligent bridging system does it all for you.

- No costly upgrades to a new Accounting / VAT / Other Spreadsheet system.

- No worry of system migration.

- Simple to use and easy to implement.

- Proven and ready for use right now.

- Always up to date for compliance.

- View your VAT returns at HMRC's website.

- VAT payment and VAT liability information provided

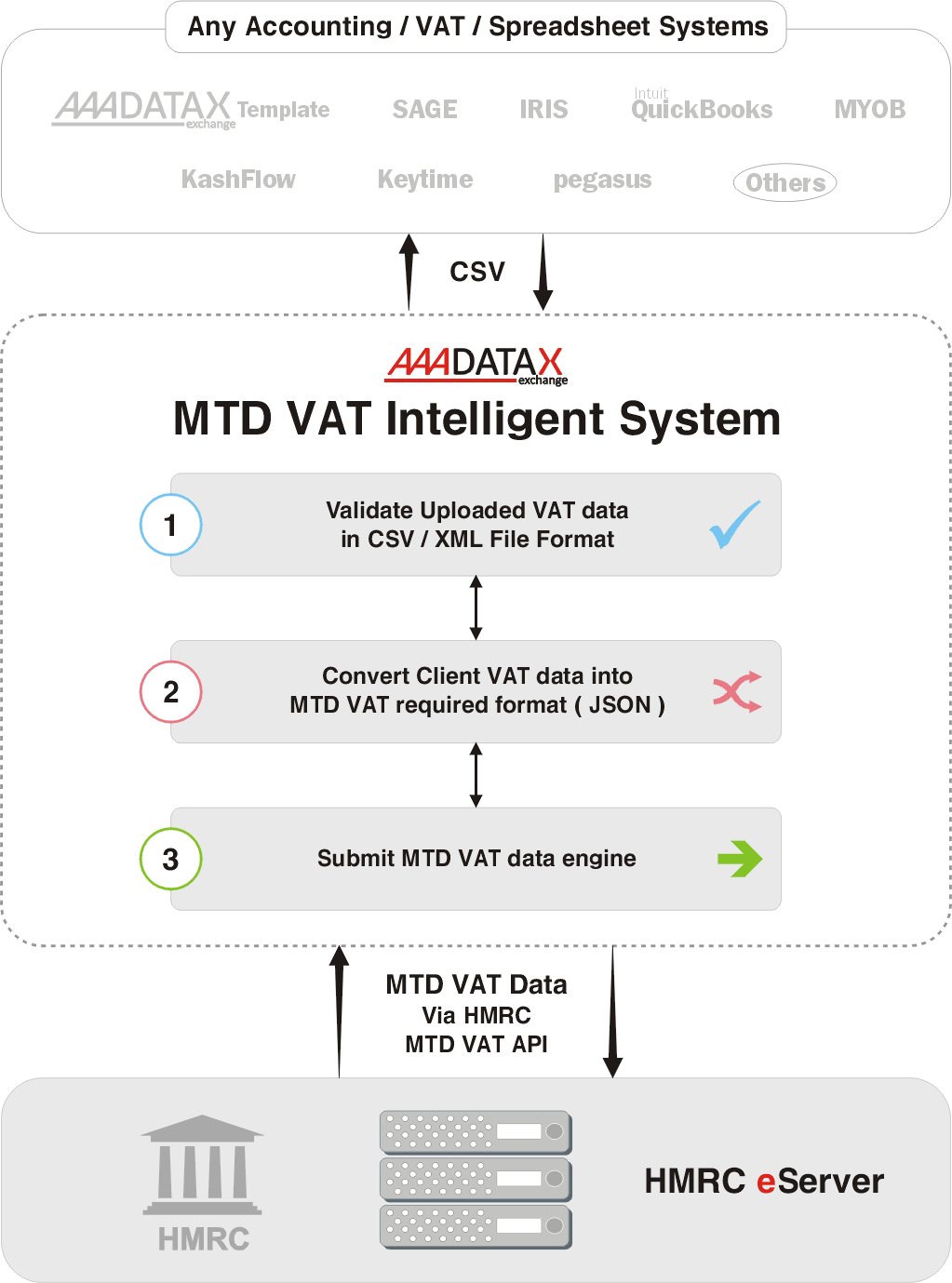

How Does MTD VAT Bridging System Works?

AAADataX MTD VAT Bridging Solution will accept any Sage, IRIS, QuickBooks, KashFlow, Keytime etc. Accounting / VAT / Other Spreadsheet system CURRENT VAT OUTPUT in CSV or XML file format and convert it into the required MTD VAT data format and further automatically e-file the MTD VAT data to HMRC through HMRC MTD API.

Users do not need to change their current Accounting / VAT / Other Spreadsheet system, saving the user from the often timely, costly and disruptive activity of upgrading or switching systems.

Stage 1: The AAADataX Bridging Solution accepts and validates your current VAT output file.

Stage 2: AAADataX Bridging Solution converts your VAT data file into the required MTD VAT format.

Stage 3: Once converted, the AAADataX Bridging Solution will submit the MTD VAT data to HMRC through the MTD VAT API.

Implementation of Bridging Solution

The implementation of AAADataX MTD VAT Bridging solution is equally simple and it can be achieved in a matter of a couple of days with the following steps.

Step 1:

Sign up to create an account

Click on SIGN UP button at AAADataX.com to create an account in the same way you create

any internet account.

Step 2:

Activate the account

Go to your email to activate your account from the activated mail link we send you. Follow that

we will lead you to our secure link for your to create your sign in secret.

Step 3:

Download the spreadsheet template

Once account is successfully created you may log on to the system to download the MTD VAT

data spreadsheet format & instruction.

Step 4:

Extract data to match

We provide comprehensive, easy to follow instructions explaining what data need to be extracted to the MTD VAT file template. The data required for the template are

the standard 9 VAT data fields plus your VAT number, company name and email.

Step 5:

Applying HMRC MTD VAT Gateway credentials

MTD VAT is a new HMRC system. All user are required to register afresh with HMRC for a new

MTD VAT gateway User ID and password to be sent to you.

Step 6:

Activate HMRC credential to grant authorisation

You need to activate the HMRC MTD VAT account at our system to complete the grant

authorisation with HMRC gateway ID and password you received from HMRC.

Step 7:

Live test

Once the HMRC grant authorisation is completed you can now upload the MTD VAT file to our

system for filing the test MTD VAT return at our separate MTD VAT test server.

Step 8:

Ready for Live use

You are welcome to use our system for making MTD VAT return under pilot scheme right now

or wait until April 2019 to file your first MTD VAT return. Which ever it may be we can assure

you is that our system will work smoothly for you once you succeed in a live test.

Step 9:

Reporting

The Bridging system provides comprehensive reports and search function for viewing all the

MTD VAT you ever made through our system. The MTD VAT data will be kept up to 6 years for

viewing at anytime 24 x 7.

Direct link to HMRC MTD VAT server is also provided to view your VAT return Data, Payment made and Liabilities due with due date.

SFTP Approach Implementation - optional function.

You may pass your MTD VAT data to us via SFTP link. The system accept MTD VAT from any

SFTP service you may use.

Please contact us at sales@AAADataX.com to start using our MTD pilot services for VAT.

© Copyright 2018 AAADataX.COM All rights reserved.

All Logos and company names featured or referred on this website are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.